Forecasting (and then delivering) cash flows is crucial to any business. Otherwise they die. I have outlined how to approach the much easier task of forecasting outflows-but how can we make credible forecasts about inflows in such an uncertain time? We use different approaches dependent on the time. Being forecasted. In this post I will concentrate on the short-term say up to 3 months.

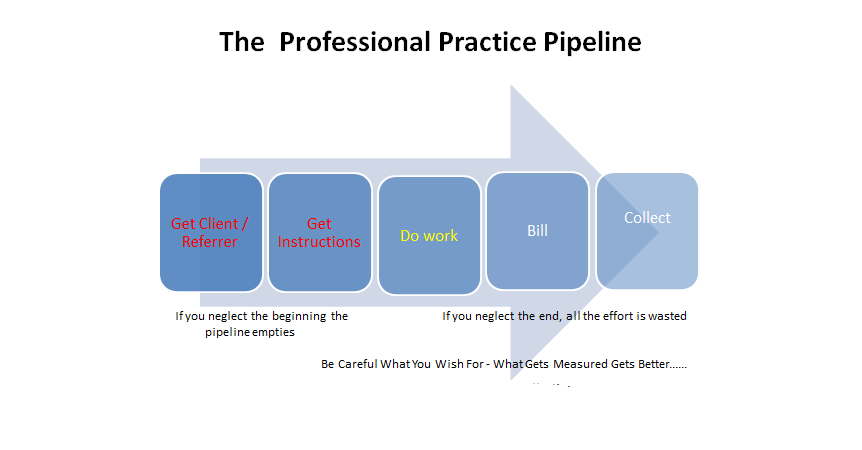

For several years we have used a five-step pipeline to model law firm Finance-

- Get client

- Get share of work

- Do work

- Bill work

- Collect fees

Each department has its own version and its own characteristics.

But we start from the premise that most collections in a 13-week timeframe will come from files which currently exist.

Firstly, we should collect the existing outstanding debtors-unless we have reason to believe otherwise. Secondly, we need to forecast the next three months billing (by department) and then identify which of that will NOT be paid in that timeframe-i.e. they will still be debtors at the end of the three-month forecasting period.

Everything else must be collected.

The billing forecast can be done in two ways. For high volume low value type work (e.g. Residential Conveyancing, Personal Injury portal, Settlement Agreements etc.) we can look at the number of transactions multiplied by the average value.

For high value work we need to use the Pareto 80/20 principle and firstly concentrate our attention on the key cases which will provide 80% of the turnover. These are especially important for sensitivity testing. One big case can make the difference between comfort and doom.

The one sure thing is that a forecast of the future will be wrong-but if we have a logical forecast with clear assumptions based largely on work that we already know we have, we have a sound base to work from.

We can then also see where we should put our attention and pressure, how much leeway we have and, if need be, we can prepare contingency plans.