Every year a majority of solicitors firms renew their Professional Indemnity Insurance on October 1. Despite regular exhortations from the market many firms leave it late but brokers still manage to come up with cover at the last minute.

Even at the best of times the PII renewal can be a time-consuming process, and it is often overlooked that there are two sets of underwriters involved-both an insurance underwriter and a credit underwriter providing the funding in advance for the annual premium.

This is not usually a problem as the specialist brokers have links to specialist lenders and both are set up to handle it smoothly.

This year looks different. Both markets for insurance and for money have hardened.

Several articles in the press recently have explained the background to the professional indemnity insurance market. Historic losses, the additional risks of remote working and concerns about financial stability following lockdown have served to reduce the overall capacity in the market and made underwriters more selective and expensive. A recent Law Society Gazette article suggested increases in the order of 30% could be widespread

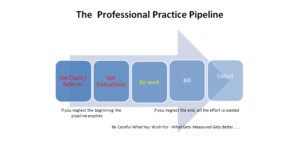

The insurance underwriters are looking for substantial firms which meet the following

- good risk management and systems,

- a good claims record,

- strong finances and

- an immaculate presentation of the proposal documents.

Providing these conditions are all met cover should be available even if at a higher price than last year.

If the above conditions are not met things could get trickier. We have already seen examples of eye watering premium increases and punitive conditions attached. Underwriters are asking far more questions, so unless the proposal presentation is immaculate there can be several iterations before cover is offered which not only takes up valuable underwriter time and capacity but delays the process overall.

So what happens if not all the parameters are met? Cover may not be available but more likely Cover may be available, at a price, leaving only the finance to be arranged

But here’s the rub

Credit underwriters are also being more selective, asking far more questions, and taking much longer to reach an answer if they are even in the market at all (many aren’t). By an unfortunate coincidence the Coronavirus Business Interruptions Loan Scheme (CBILS) closes on September 30, so credit underwriters will be busy processing the last-minute applications under that scheme.

An influx of solicitors professional indemnity insurance applications could leave them overloaded-and take the turnaround time past October 1, even if successful. We’ve already seen credit applications which would normally take 48 hours to turn round take almost 2 weeks. And even then not all have been successful.

It is now early September, so there is less than a month to renewal. If you meet all of the conditions described above you should progress through the green channel and should still have time.

But simple arithmetic says that you need to be getting both your cover and funding agreed in parallel or you could already be too late.