‘It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so’.

The Oscar-winning 2015 film “The Big Short”

In this is article Bob Spence and Barry Wilkinson will focus you on using your existing people skills to become one of your sectors recognised Rainmakers.

https://www.dictionary.com/browse/rainmaker

Our opening statement was attributed to Mark Twain who was clearly ahead of his time as many of his quotes are relevant to Rainmaking. According to our data-to-results experiences, covering the last 27 years, there are recognisable trends that are strategic errors in business development.

All you need in this life is ignorance and confidence and then success is sure

Mark Twain

The first one error is this. It is vital to be able to identify and describe with immense clarity the people that should form part of your Rainmaking network. Very few people can do this.

So, our first key question is what type of network should you be building?

Can you answer that question accurately?

It is worth a reflection, so be honest with yourself.

Can you describe your ideal network of connections in detail? Can you explain to your peers and colleagues why you would need this type of network to succeed as a Rainmaker?

Due to the urgency and pressures that Rainmakers are facing our network algorithm research looked at the popular myths and misconceptions that all lawyers are surrounded with. Many of these myths are constantly being reinforced. Our findings explored why we should question them.

Aleksandra Gora, CEO of Rainmaker PRO software with Professor T. Turowski

Think of the amount of time that is spent on crafting the professional ritual that is the ‘business-card-exchange’. Whether you refer to it as the ‘elevator-pitch’ or ’60-second-introduction’ or whether you deliver this business-card-exchange informally within mixer events or formally within the context of a ‘speed-event’ you are essentially an ‘aspirin looking for a headache’?

It is better to keep your mouth closed and let people think you are a fool than to open it and remove all doubt

Mark Twain

Why is this process given so much credibility? There are best-selling books, well known speakers, training programmes delivered at a high premium and webinars that embed this process as a ‘must-have-skill’ into the successful Rainmaker.

Why would this process have the ability to create the right Rainmaking connections?

It is actually very difficult to apply science to your network of Rainmaking connections.

This would be to provide an accurate understanding of how you are hitting your revenue figures. Is it because of your network or in spite your network?

Get your facts first and then you can distort them as you please

Mark Twain

However, this need not be so. All of us working at developing our practice on a day to day basis wrestle with two conflicting trains of thought.

The first is that it makes sense that generating outstanding commercial results as a lawyer requires a lean, well-managed, well thought-out, strategic networking plan. You have only so many hours in the day, and there is no time to waste effort networking and deliver your Rainmaking in the wrong areas.

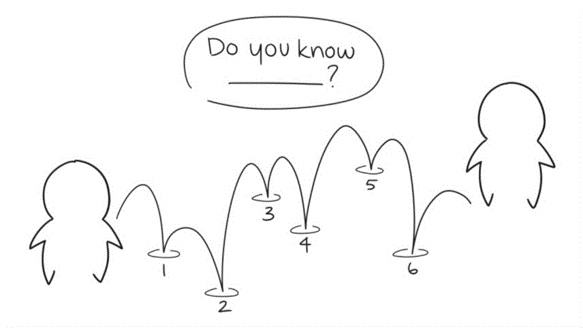

This train of thought competes with the second which is that that this activity is essentially a “numbers game.” If you want to win the lottery, you have to buy a ticket.

The second thought generally overrides the first. There is so much more positive noise around this argument. Many lawyers adopt a set of actions enabling them to create minimal professional connectivity to the largest number of people possible. This second approach is reinforced continually by measuring the activity around investing time into developing new relationships. This can be on-line and off-line.

Let us make a special effort to stop communicating with each other so that we can have some conversation.

Mark Twain

This is the ongoing consideration of quantity versus quality in an approach to hitting our client acquisition targets. You have to make strategic decisions in terms of what works for you in the context of your time and what you offer professionally. These articles in 2020 will help you make those choices.

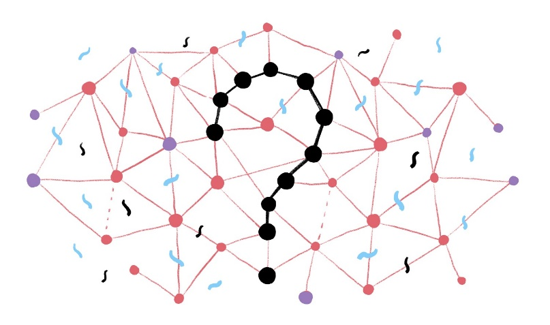

Keep in mind that a maximum of 3°of separation is the introduction threshold to improving your network development. Our extensive use of algorithms showed these powerful results:

Someone who knows you well and is able to introduce you to someone that they know well is communicating your value within 1° of separation. The likelihood that an introduction could happen through a well-positioned request is a maximum of 82%.

Someone who knows you well and knows another party really well being able to influence that second party to introduce you to another party is communicating your value within 2° of separation. The likelihood that an introduction could happen through a well-positioned request is a maximum of 17%.

If we push this formula to add another chain to it which means communicating your value within 3° of separation through a well-positioned request has a maximum likelihood of 0.8%.

As your time is money these are actually financial odds so why would you even consider anything beyond 1° of separation? (A random business-card-exchange is not even in this measurement system).

You are in a casino and investing time. What odds would you play to?

I doubt if many of us would bet against James Bond but in reality, you are if you ignore the 3° of separation thinking. Our extensive use of algorithms asks:

Does this new connection have the likelihood to be an improvement on who you already know, and are they within 3°or less of a meaningful introduction?

Is this new person already within a chain of three introductions to you? Is there someone in the room that can vouch that you are a person worth knowing? (That is 1°of separation). Is that person able to follow through for you? If not, then apart from professional courtesy requirements, will they really form part of your strategic network on the basis of your ‘business-card-exchange’.

This approach may be at odds that only the fees earned should be measured. This is a view that Rainmaking effort on a week to week basis is irrelevant unless it scores generates fees/wins clients. Networking management is also Rainmaking effort and is the key to ensuring that you are continually 1°of separation from a fee earning introduction.

There are lies, damned lies and statistics.

Mark Twain

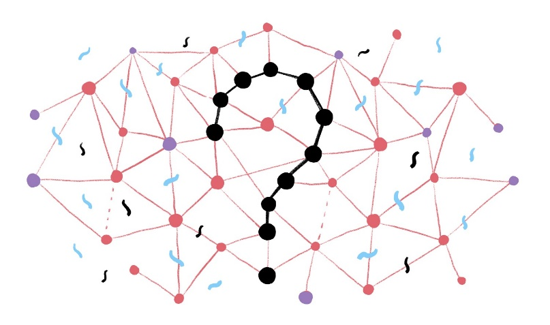

Our thinking based on analysing networking results thoroughly is that you must manage your connections ruthlessly and to the highest standard possible to differentiate yourselves from the competition in terms of networking behaviour. Every new connection has to survive the 3° of separation benchmark. If it does so, when you need to manage only the connections that fit within this framework.

We still, of course, have the same number of client hours per week to work with as we did twenty-five years ago; at the same time, the client can access our online presence 24/7.

Finally, as business development professionals we are constantly being challenged with the concept of “return on engagement” against the Rainmaking actions we take. So how do we measure this consistently apart from immediate revenue returns?

As an overview, here are some of the vital questions we will help you understand in our 2020 articles:

1) Why can the returns on business development networking deteriorate?

2) What are the major networking pitfalls we must avoid?

3) What are the skills we need to avoid the reduction of return of effort?

4) How do we pick out the most appropriate people to connect and network with?

5) What information do we need to build our network?

6) What are the current best practices in business development behaviour?

7) What are the best methods of implementing a networking plan?

8) Why is 3°of separation of separation the only benchmark in a strong strategy?